Errors can occur in both the recordkeeping systems of both the bank and the depositor. Book transactions are transactions that have been recorded on your books but haven’t cleared the bank. As a small business, you may find yourself paying vendors and creditors by issuing check payments. Companies face several challenges when reconciling bank statements to financial activities, so it’s important to highlight common problems you may encounter. After you’ve received bank statements, establish the last reconciled transaction from the previous period and begin there.

- Begin with a side-by-side comparison of your bank account statement and your company’s accounting records.

- He has been quoted by publications like Readers Digest and The Wall Street Journal.

- Nevertheless, on 5 June, when the bank pays the check, the difference will cease to exist.

- The reconciliation statement allows the accountant to catch these errors each month.

The Benefits of Reconciling Your Bank Account

In the case of personal bank accounts, like checking accounts, this is the process of comparing your monthly bank statement against your personal records to make sure they match. Many banks allow you to opt for fee-free electronic bank statements delivered to your email, but your bank may mail paper bank statements for a fee. Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement. This process helps you monitor all of the cash inflows and outflows in your bank account. The reconciliation process also helps you identify fraud and other unauthorized cash transactions.

Table of Contents

Ideally, you should run a reconciliation each time you receive the statement from your bank. The bank may send you a bank statement at the end of each month, each week, or, if your business has a large number of transactions, they may even send one at the end of each day. Journal entries, also known as the cash flow from assets calculator original book of entries, refer to the process of recording transactions as debits and credits, and once these are recorded, the general ledger is prepared. Such errors are committed while recording the transactions in the cash book, so the balance as per the cash book will differ from the passbook.

Reasons of difference between bank records (bank statement) and depositor’s accounting record:

As a result, it is critical for you to reconcile your bank account within a few days of receiving your bank statement. We’ll explore the definition of bank reconciliation, why it’s important, and a step-by-step process for performing bank reconciliations. We’ll also look at common sources of discrepancies between financial statements and bank statements to help you identify fraud risks and errors.

Similarly, if a businessman deposits any checks on the last day of the month, these cheques may be collected by his bank and shown on his bank statement three or four days later. Similarly, some checks credited to the ledger account will probably not have been processed by the bank prior to the bank statement date. One of the procedures for establishing the correct cash balance (and for controlling cash) is the reconciliation of the bank and book cash balances.

These debits made by the bank directly from your bank account will lead to a difference between balances. Therefore, an overdraft balance is treated as a negative figure on the bank reconciliation statement. After adjusting all the above items, you’ll end up with the adjusted balance as per the cash book, which must match the balance as per the passbook. Errors in the cash account result in an incorrect amount being entered or an amount being omitted from the records. The correction of the error will increase or decrease the cash account in the books.

Deposits in transit are amounts that are received and recorded by the business but are not yet recorded by the bank. When the bank pays out cash against that cheque, it records the payment on the debit column of his statement of account. On the bank’s side, the record is usually kept in the form of a personal account. It is maintained more or less along the same lines as a businessperson maintains their personal accounts for debtors and creditors. Generally, the responsibility for performing a bank reconciliation falls on an individual designated as the “bookkeeper” or accountant within the company.

The bank section lists items in transit from the depositor to the bank and bank errors. The book section lists items in transit from the bank, service charges, and depositor errors. This is a simple data entry error that occurs when two digits are accidentally reversed (transposed) when posting a transaction. For example, you wrote a check for $32, but you recorded it as $23 in your accounting software. Note that this process is exclusively for reconciliations performed by hand.

Matching the payment to an invoice can be challenging if the payments are ongoing, so it’s important to reference payments to an invoice number so you can easily identify a double payment. Due to the overwhelming paperwork that the financial department deals with, it’s possible that some invoices get misplaced or are never recorded. Also, if you’ve made a check payment at the end of the month, it might not clear until the following reporting period. Kevin has been writing and creating personal finance and travel content for over six years. He is the founder of the award-winning blog, Family Money Adventure, and host of the Family Money Adventure Show podcast. He has been quoted by publications like Readers Digest and The Wall Street Journal.

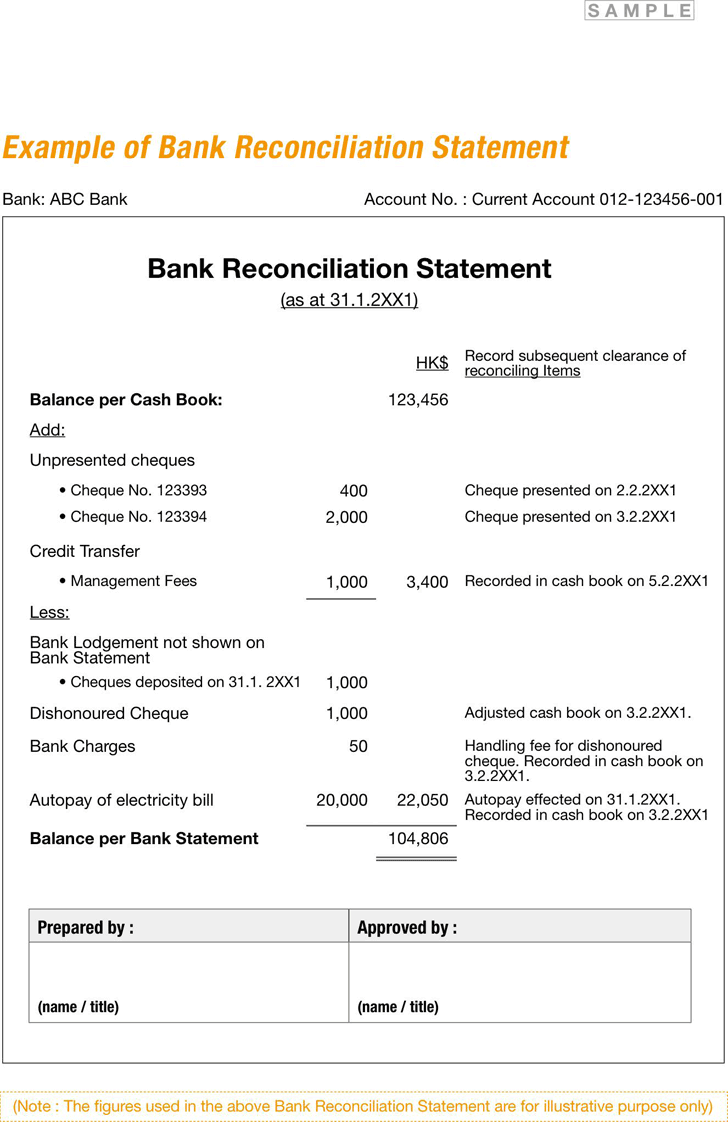

Performing regular bank reconciliations is key to keeping on top of your company’s financial health and paving the way for sustainable business growth. A company prepares a bank reconciliation statement to compare the balance in its accounting records with its bank account balance. A bank reconciliation statement is a valuable internal tool that can affect tax and financial reporting and detect errors and intentional fraud.

Hinterlasse einen Kommentar