It has already been mentioned that it is essential to update and correct the accounting records to find the correct and true profit or loss of the business. Similarly, under the realization concept, all expenses incurred during the current year are recognized as expenses of the current year, irrespective of whether cash has been paid or not. Also, according to the realization concept, all revenues earned during the current year are recognized as revenue for the how do you calculate the gain or loss when an asset is sold current year, regardless of whether cash has been received or not. If you haven’t decided whether to use cash or accrual basis as the timing of documentation for your small business accounting, our guide on the basis of accounting can help you decide. There’s an accounting principle you have to comply with known as the matching principle. The matching principle says that revenue is recognized when earned and expenses when they occur (not when they’re paid).

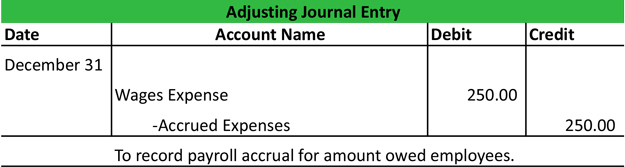

Adjusting Entry for Accrued Expense

In this case, the company’s first interest payment is to be made on March 1. However, the company still needs to accrue interest expenses for the months of December, January, and February. Then, in March, when you deliver your talk and actually earn the fee, move the money from deferred revenue to consulting revenue. If you have a bookkeeper, you don’t need to worry about making your own adjusting entries, or referring to them while preparing financial statements. If you do your own accounting and you use the cash basis system, you likely won’t need to make adjusting entries.

( . Adjusting entries that convert liabilities to revenue:

With an adjusting entry, the amount of change occurring during the period is recorded. Similarly for unearned revenues, the company would record how much of the revenue was earned during the period. Misapplication of depreciation and amortization methods can also lead to significant errors. Choosing an inappropriate method or failing to update the useful life of an asset can result in incorrect expense allocation. For instance, using the straight-line method for an asset that experiences rapid wear and tear may understate the depreciation expense in the early years and overstate it in the later years.

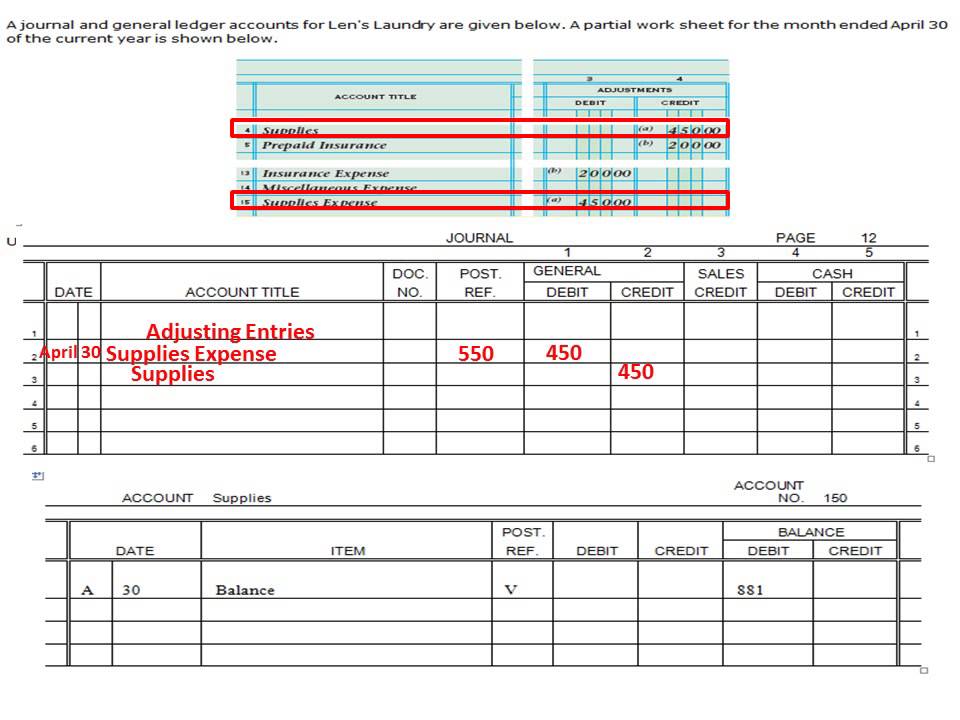

- The adjusting entry ensures that the amount of supplies used appears as a business expense on the income statement, not as an asset on the balance sheet.

- For example, if an adjustment entry is made to increase accounts receivable, this will increase the amount of cash that the business expects to receive in the future.

- In this sense, the company owes the customers a good or service and must record the liability in the current period until the goods or services are provided.

- Over time, as the benefit of these prepaid expenses is realized, the asset is reduced, and the expense is recognized.

Accounting Adjustments

One of the most common mistakes is making incorrect accounting entries. This can happen due to a lack of attention to detail or a misunderstanding of accounting principles. To avoid this mistake, it is essential to double-check all entries and ensure that they are accurate.

Adjusting entries follows the accrual principle of accounting and makes necessary adjustments that are not recorded during the previous accounting year. The adjusting journal entry generally takes place on the last day of the accounting year and majorly adjusts revenues and expenses. An adjusting entry is an entry made to assign the right amount of revenue and expenses to each accounting period. It updates previously recorded journal entries so that the financial statements at the end of the year are accurate and up-to-date.

Here are the ledgers that relate to the purchase of prepaid taxes when the transaction above is posted. Here are the Prepaid Rent and Rent Expense ledgers AFTER the adjusting entry has been posted. Here are the Prepaid Insurance and Insurance Expense ledgers AFTER the adjusting entry has been posted.

Our Adjusting Entries Cheat Sheet provides examples of the typical accrual, deferral, and other adjusting entries. Adjusting Entries reflect the difference between the income earned on Accrual Basis and that earned on cash basis. This enables us to arrive at the true result of business activities for a given period (e.G., Whether we made profits or suffered losses). The primary objective of accounting is to provide information that will help management take better decisions and plan for the future. It also helps users (lenders, employees and other stakeholders) to assess a business’s financial performance, financial position and ability to generate future Cash Flows. The updating/correcting process is performed through journal entries that are made at the end of an accounting year.

To record the allowance for doubtful accounts, an adjusting entry is made to increase the allowance for doubtful accounts expense account and decrease the corresponding asset account. Accumulated depreciation is the total amount of depreciation recorded for a long-term asset since it was acquired. To record accumulated depreciation, an adjusting entry is made to increase the accumulated depreciation account and decrease the corresponding asset account. The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized. With cash accounting, this occurs only when money is received for goods or services.

Net income and the owner’s equity will be overstated, while expenses and liabilities understated. In October, cash is recorded into accounts receivable as cash expected to be received. Then when the client sends payment in December, it’s time to make the adjusting entry. Overall, adjustment entries play a crucial role in ensuring the accuracy and reliability of financial statements.

Book Value is what a fixed asset is currently worth, calculated by subtracting an asset’s Accumulated Depreciation balance from its cost. As a college student, you have likely been involved in making a prepayment for a service you will receive in the future. If you want to attend school after the semester is over, you have to prepay again for the next semester. Here are the ledgers that relate to the purchase of prepaid rent when the transaction above is posted. Here are the ledgers that relate to the purchase of prepaid insurance when the transaction above is posted. Liabilities also include amounts received in advance for a future sale or for a future service to be performed.

The adjustments made in journal entries are carried over to the general ledger that flows through to the financial statements. Sometimes companies collect cash from their customers for goods or services that are to be delivered in some future period. Such receipt of cash is recorded by debiting the cash account and crediting a liability account known as unearned revenue. At the end of the accounting period, the unearned revenue is converted into earned revenue by making an adjusting entry for the value of goods or services provided during the period. A business needs to record the true and fair values of its expenses, revenues, assets, and liabilities.

Hinterlasse einen Kommentar