Our quizzes are rigorously reviewed, monitored and continuously updated by our expert board to maintain accuracy, relevance, and timeliness. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- For U.S. companies, the monetary unit assumption allows accountants to express a company’s wide-ranging assets as dollar amounts.

- Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Revenue recognition principle

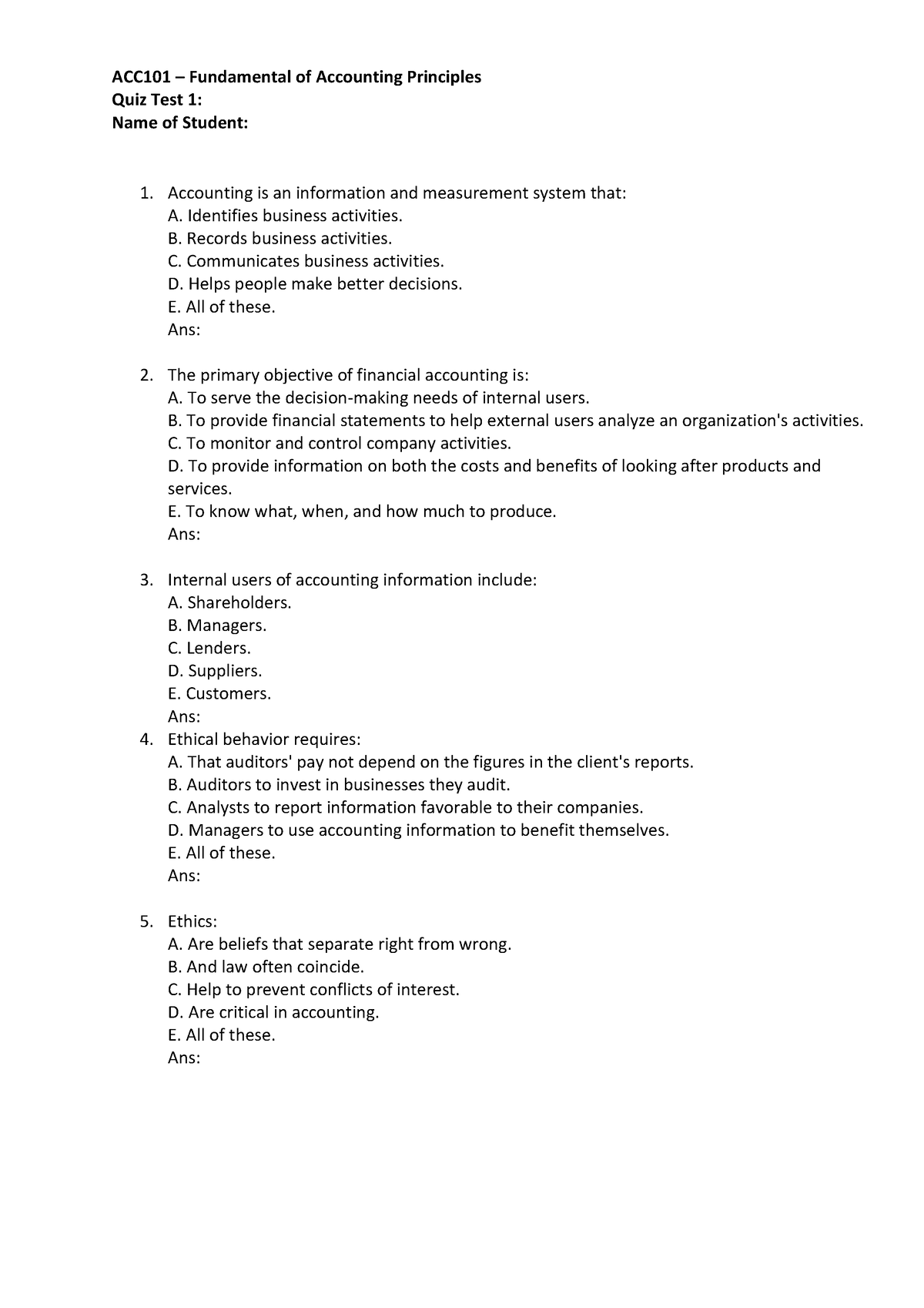

Test your knowledge with this multiple choice question (MCQ) test on accounting principles and concepts. If you’re unsure about any questions, you can read about this topic in detail in the explanation section. flight crew cell phone and data plan tax deduction rules Under the accrual basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid.

Quizzes

In 2009, the FASB launched the Accounting Standards Codification (ASC or Codification), which it continues to update. This electronic database contains the official accounting standards (the equivalent of many thousands of printed pages) which apply to the financial reporting of U.S companies and not-for-profit organizations. So, how did you score on the accounting principles practice test above?

Accounting Principles Matching Questions

If the company is not considered to be a going concern (meaning the company will not be able to continue in business), it must be disclosed, and liquidation values become the relevant amounts. We begin with brief descriptions of many of the underlying principles, assumptions, concepts, constraints, qualitative characteristics, etc. CFI is the official global provider of the Financial Modeling and Valuation Analyst (FMVA)™ certification program, designed to transform anyone into a world-class financial analyst. Enroll now to gain the skills you need to take your career to the next level.

Quiz 5: Basic Accounting Principles Quiz

We’ve answered 242 popular questions related to the topic Accounting Principles. Review them all or use the search box found at the top of each page of our website for your specific questions. Use AI to generate personalized quizzes and flashcards to suit your learning preferences. Ace your exams with our all-in-one platform for creating and sharing quizzes and tests. Ask a question about your financial situation providing as much detail as possible.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. If you find Accounting Principles terminology difficult, this Word Scramble will provide clues (scrambled answers) to assist you. This 20-question quiz is a fast way to assess your understanding of the Accounting Principles Explanation.

When a cause-and-effect relationship isn’t clear, expenses are reported in the accounting period when the cost is used up. For example, the $120,000 cost of equipment with a 10-year life will be charged to expense at a rate of $1,000 per month. To report a company’s net income for each month, the company will prepare adjusting entries to record each month’s share of depreciation expense, property taxes, insurance, etc. It will also prepare adjusting entries for expenses that occurred but were not paid. The going concern assumption means the accountant believes that the company will not be liquidated in the foreseeable future.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Hinterlasse einen Kommentar